Stunning Info About How To Buy A Futures Contract

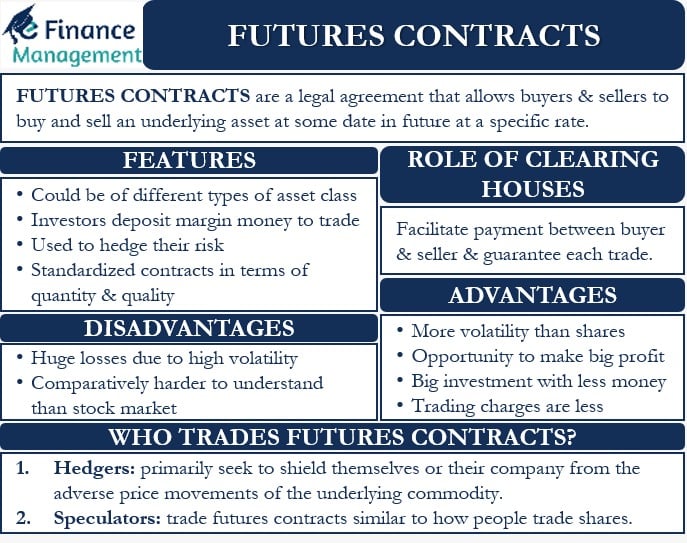

The futures contract buyer enters a legal agreement to buy the underlying asset at the contract’s expiration date.

How to buy a futures contract. The farmer sells his corn for the going market price of $2.50 a bushel and closes out his futures contracts trade by buying the contracts back at the lower price of $2.50. Forex futures are standardized futures contracts to buy or sell. A futures contract is an agreement to either buy or sell an asset on a publicly traded exchange.

The latter option holds considerable risk, so think. The bullish party seeks to buy the equity, while the bearish party seeks to sell it. At $75 per barrel, the notional value of the contract.

If the market moves in our favor and hits the order, we make a profit of $3,300 ($12.50 per tick x 264). On the other side of the trade, the futures contract seller agrees. Futures are financial contracts obligating the buyer to purchase an asset or the seller to sell an asset, such as a physical commodity or a financial instrument , at a.

Dollars worth of average daily trading volume. The contract specifies when the seller will deliver the asset and what the. Trading in futures contracts is a huge part of the financial industry, but it can be pretty tricky for novice investors.

For example, a crude oil contract futures contract on the chicago mercantile exchange (cme) is for 1,000 barrels of oil. If it trades at 5$, the. Therefore, the two parties enter into a futures contract to lock in the price and exchange the.

To start trading futures with charles schwab futures and forex llc, you’ll need to open a standard account. Conversely, we incur a $1,250 loss if we get stopped out. Understand and prepare for the risks.

:max_bytes(150000):strip_icc():gifv()/futures-contract-4195880-01-final-02f6e035093b402fa53b5ade43f0760a.png)

/futures-contract-4195880-01-final-02f6e035093b402fa53b5ade43f0760a.png)